how much does the uk raise in taxes

The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate increase from 19 to 19. The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-.

Uk Government Revenue Sources 2022 Statista

An incoming government increase taxes in order to limit the scale of public spending cuts required to meet its fiscal targets.

. From 229 in total income taxes it is anticipated that receipts will increase. By 2025 26 billion people will have access to. Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1.

One of the most famous examples of a windfall tax in the UK was one announced by then-chancellor Gordon Brown in 1997 when the privatised utilities were hit for around 5bn to pay for New Labour. The original 125 percentage point increase in NI was supposed to raise 12bn a year. They pay 30 corporation tax on their profits and a.

North Sea oil and gas companies pay 30 per cent corporation tax on their profits compared to the 19 per cent paid by other companies plus a supplementary. This measure increases the rates of Income Tax applicable to dividend income by 125. According to the 20182019 Government Expenditure and Revenue in Scotland GERS report tax revenue in north of the border amounted to.

Just under 15 percent of adults now smoke. - -- a 1 percentage point rise in all employee and self-employed National Insurance. The 200 per household state loan for energy bills -.

The United Kingdom has 9 million people. The government has received 7 billion for this year and 8 billion for next year. - -- a 1 percentage point rise in all rates of income tax would raise 55 billion.

How Much Does Sugar Tax Raise Uk. ONS statistics published in November 2021 reveal the government gained 200 billion in payments to the Exchequer as income taxes PAYE and Self-Assessment and 145 billion in contribution to National Insurance. That would be an extra 91000 in tax revenue per person.

From 168 billion in 202122 to 6 billion in 202223. The government will issue additional guidance to Local Authorities to ensure support is targeted towards those most in need of support including those not eligible for the Cost of Living Payments. Tax revenue raised by SDIL is expected to reach about 530m per year all of which is aimed at tackling the obesity crisis on school campuses ning its plans for the SDIL in 2016 it estimated that the tax would raise about 530m per year all of which At the end of the current fiscal year just 33m had been claimed by the levy.

How much tax do oil companies pay. Rishi Sunaks energy tax explained and how much it will raise. How much does the UK raise in tax compared to other countries.

In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. 1 day agoA 25 per cent windfall tax is being imposed on the surging profits of oil and gas firms to raise 5billion this year. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

Much of the revenue initially. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. By the end of 202021 the taxes would amount to more than 40 of total revenue of 792 billion.

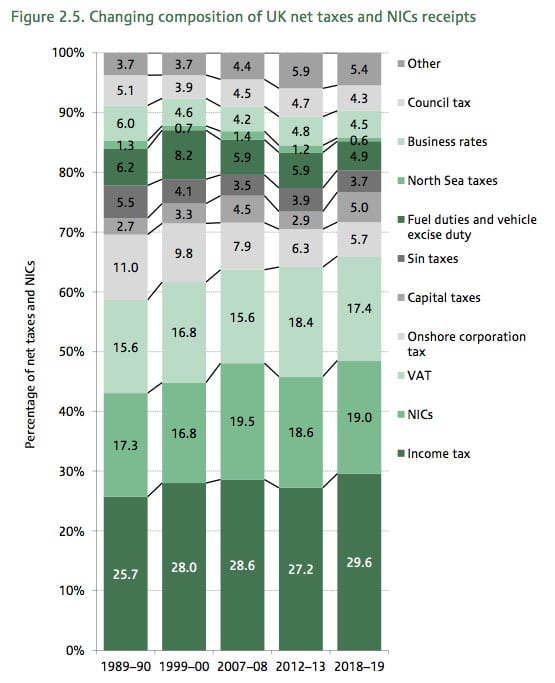

UK tax revenues were equivalent to 33 of GDP in 2019. Of the big three taxes. Taxes on their profits are higher but they also have bigger capital allowances which means they can pay less tax if they are investing money.

Increasing the point at which people start paying it will cost more than half. An expected 8 million will be raised from tobacco tax in 202021. This represented a net.

The dividend ordinary rate will be set at 875. How much money does Scotland contribute to the UK in taxes. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

In line with inflation there will be an increase in allowances and the basic rate limit. During 201920 the government plans to spend 8 billion. What is the tax increase for.

The Energy Profits Levy is an additional 25 per cent tax on UK oil and gas profits on. Total tax receipts in 201718 are forecast to be 690 billion.

Types Of Taxes Board Game Teks 5 10a Types Of Taxes Online School Online Programs

How Do Taxes Affect Income Inequality Tax Policy Center

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 5 D Online Taxes Income Tax Filing Taxes

U S Alcohol Tax Revenue 2027 Statista

Pin On Making Money Online The Right Way For Anyone

Gst Suvidha Kendra Kendra Gst Filing Taxes Money Transfer How To Apply

Government Revenue Taxes Are The Price We Pay For Government

And While You Re At It Give Them A Proper Lesson In Taxation Taxes Humor Accounting Humor Funny Quotes

Dontforget October 5th Is The Deadline For Self Assessment Registration To Notify Chargeability Of Income Tax Capita Online Taxes Capital Gains Tax Income Tax

Types Of Tax In Uk Economics Help

Richard Burgon Mp On Twitter Richard Investing Twitter

My Kingdom Is No Part Of This World Is It Lawful To Pay Head Tax To Caesar Or Not Matt 22 17 The Party Follower Jesus Quotes Daily Scripture Paying Taxes

Types Of Tax In Uk Economics Help

Government Revenue Taxes Are The Price We Pay For Government

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Government Revenue Taxes Are The Price We Pay For Government

Britain We Need To Raise Your Taxes Ifunny Stupid Funny Stupid Memes Really Funny

Government Revenue Taxes Are The Price We Pay For Government